Aggregate Demand (AD): shows the amount of Real GDP that the private, public and foreign sector collectively desire to purchase at each possible price level.

- The relationship between the price level and the level of Real GDP inversely related

- Curve goes downward

Three Reasons why AD is Downward Sloping

1) Real-Balances Effect: when the price level is high households and businesses cannot afford to purchase as much output

- when the price level is low, households and businesses can afford to purchase more output

2) Interest-Rate Effect: a higher price level increases the interest rate which tends to discourage investment.

- A lower price level decreases the interest which tends to encourage investment.

3) Foreign Purchases Effect: A higher price level increases the demand for relatively cheaper imports

- A lower price level increases the foreign demand for relatively cheaper US exports

Shifts in Aggregate Demand (AD)

- there are two parts to a shift in AD:

- A change in C, Ig, G, and/or Xn

- A multiplier effect that produces a greater change than the original change in the 4 components

Determinants of AD:

1) Consumption: household spending is affected by:

- consumer wealth (more wealth = more spending, AD Shifts right) (less wealth = Less. Spending, AD shifts left)

- Consumer Expectations (positive expectations = more spending,AD shifts right, negative expectations = less spending, AD shifts left)

- Household Indebtedness

- less debt = more spending, AD shifts right

- more debt = less spending, AD shifts left

- Taxes

- less taxes = more spending, AD shifts right

- more taxes = less spending, AD shifts left

2) Gross Private Investment:

- Investment Spending is sensitive to:

- The Real Interest Rate

- Lower Real Interest Rate = More Investment, AD shifts right

- Higher Real Interest Rate = Less

Investment, AD shifts left

- Expected Returbs

- higher expected returns = more investment, AD shifts right

- lower expected returns = less investment, AD shifts left

- Expectrd Returns are influenced by expectations of future profitability, technology, degree of excess capacity (existing stock of capital), business taxes)

3) Government Spending

- more government spending shifts AD right

- less government spending shifts AD left

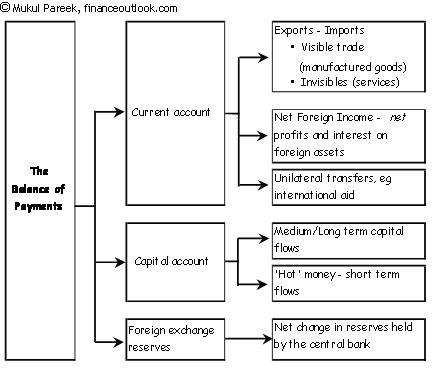

4) Net Exports

- Net exports are sensitive to

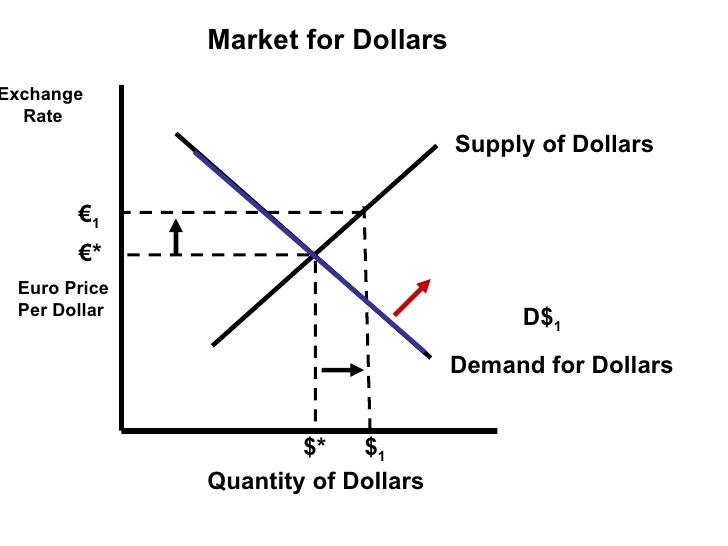

- Exchange Rates (International Value of $)

- Strong $ = more imports and fewer exports, AD shifts left

- Weak $ = fewer imports and more exports, AD shifts right

- Relative Income

- String Foreign Economics = More Exports, AD shifts right

- Weak foreign economies = less exports, AD shifts left

Aggregate Supply: The level of Real GDP

Long-Run: Peruod of time where input prices are completely flexible and adjust to changes in price level

- In the long run, the level of real GDP supplied is independent of the price level

Short Run: Period of time where input prices are sticky and do not adjust to changes in the price level

- the level of Real GDP a supplied is directly related to the price level

LRAS: marks the level of full employment in the economy (analogous to PPC)

- because input prices are completely flexible in the long-run, changes in price-level do not change firms' real profits and therefore do not change firms' level of output. This means that the LRAS is vertical at the economy's level of full employment

SRAS: Because input prices are sticky in the short-run, the SRAS is upward sloping. this rejects the fact that in the short run, increases in the price level increase firm's profits and create incentives to increase output.

Changes in SRAS:

- an increase in SRAS a is seen as a shift to the right. Decrease is shift to the left

- The key to understanding shifts in SRAS is per unit cost of production

* (Per-unit production cost) = (total input cost) / (total output)

Determinants of SRAS (all of the following affect unit production cost):

1) input prices

2) productivity

3) legal institutional environment

Input Prices

- Domestic Resource Prices

- Wages (75% of all business costs)

- Cost of capital

- Raw Materials (commodity prices)

- Foreign Resource Prices

- Strong $ = lower foreign resource prices

- Weak $ = higher foreign resource prices

- Market Power

- Monopolies and cartels that control resources control the price of those resources

- Increases in resource Prices = SRAS shifts left

- Decreases in Resource Prices = SRAS shifts right

Productivity

- (Productivity) = (total output) / (total inputs)

- More productivity = lower unit production cost = SRAS shifts right

- Lower productivity = higher unit production cost = SRAS shifts left

Legal-Institutional Environment

- Taxes and Subsidies:

- Taxes ($ to govt) on business increase per unit production cost = SRAS shifts shifts left

- Subsidies ($ from govt) to business reduce per unit production cost = SRAS shifts right

- Government Regulation

- Government regulation creates a cost of compliance = SRAS shifts left

- Deregulation reduces compliance costs = SRAS shifts right

Full Employment equilibrium exists where AD intersects SRAS & LRAS at the same point.

A recessionary gap exists when equilibrium occurs below full employment output.

Anytime you're in a recession or recessionary gap, AD is shifting to the left (decreasing)

An inflationary gap exists when equilibrium occurs beyond full employment output. AD shifts to the right (increase)

Investment: money spent or expenditures on: new plants (factories), capital equipment (machinery), technology (hardware & software), new homes, inventories (goods sold by producers)

Expected Rates of Return:

1) How does business make investment decisions? Cost/Benefit Analysis

2) How does business determine the benefits? Expected rate of return

3) How does business count the cost? Interest costs

4) How does business determine the amount of investment they undertake? Compare expected rate of return to interest cost. If expected return > interest cost, then invest. If expected return < interest cost, do not invest.

Real (r%) vs Nominal (i%)

- Nominal is the observable rate of interest. Real subtracts out inflation (pi%) and is only known ex post facto.

r% = i% - pi%

- What then, determines the cost of an investment decision? The real interest rate (r%)

Investment Demand Curve (ID)

- What is the shape of the investment demand curve? Downward sloping

- Why? When interest rates are high, fewer investments are profitable; when interest rates are low, more investments are profitable.

Shifts in Investment Demand (ID):

1) Cost of Production

- Lower costs shift ID right

- Higher costs shift ID left

2) Business Taxes

- Lower business taxes shift ID right

- Higher business taxes shift ID left

3) Technological Change

- New technology shifts ID right

- Lack of technological change shifts ID left

4) Stock of Capital

- If an economy is low on capital, then ID shifts right

- If an economy has much capital, then ID shifts left

5) Expectations

- Positive expectations shift ID right

- Negative expectations shift ID left

Long-Run Aggregate Supply

- LRAS curve represents a point on an economy's production possibility curve.

- The LRAS is a vertical line at an output level that represents the quantity of goods and services a nation can produce over a sustained period using all of its productive resources as efficiently as possible.

- LRAS is always at full employment. It does not change as the price level changes.

- LRAS shifts outward if there is a change in technology, a change in resource, or if there is economic growth.

Disposable Income: income after taxes or net income.

DI = Gross Income - Taxes

- With disposable income, households can either:

1) Consume (spend money on goods & services)

2) Save (not spend money on goods & services)

Consumption:

- Household spending

- The ability to consume is constrained by:

- The amount of disposable income

- The propensity to save

- Do households consume if DI = 0?

- Autonomous consumption

- Dissaving

- APC = C/DI = % DI that is spent

Saving:

- Household NOT spending

- The ability to save is constrained by:

- The amount of disposable income

- The propensity to consume

- Do households save if DI = 0?

- NO

- APS = S/DI = % DI that is not spent

APC & APS

- APC + APS = 1

- 1 - APC = APS

- 1 - APS = APC

- APC > 1 .: Dissaving

- -APS .: Dissaving

MPC & MPS

- Marginal Propensity to Consume

- Change in C / Change in DI

- % of every extra dollar earned that is spent

- Marginal Propensity to Save

- Change in S / Change in DI

- % of every extra dollar earned that is saved

- MPC + MPS = 1

- 1 - MPC = MPS

- 1 - MPS = MPC

The Spending Multiplier Effect

- An initial change in spending (C, Ig, G, Xn) causes a larger change in aggregate spending, or Aggregate Demand (AD).

- Multiplier = Change in AD / Change in Spending

- Multiplier = Change in AD / Change in C, Ig, G, or X

- Why does this happen? Expenditures and income flow continuously which sets off a spending increase in the economy.

- The Spending Multiplier can be calculated from the MPC or the MPS

- Multiplier = 1 / (1-MPC) or 1/MPS

- Multipliers are (+) when there is an increase in spending and (-) when there is a decrease.

Calculating the Tax Multiplier

- When the government taxes, the multiplier works in reverse

- Why? Because now money is leaving the circular flow.

- Tax Multiplier (note: it's negative)

= -MPC/(1-MPC) or -MPC/MPS

- If there is a tax-CUT, then the multiplier is + because there is now more money in the circular flow

Fiscal Policy: Changes in the expenditures or tax revenues of the federal government

2 Tools of fiscal policy:

- Taxes: Government can increase or decrease taxes

- Spending: Government can increase or decrease spending

Deficits, Surpluses, & Debt

- Balanced Budget: Revenues = Expenditures

- Budget Deficit: Revenues < Expenditures

- Budget Surplus: Revenues > Expenditures

- Government Debt: (Sum of all deficits) - (Sum of all surpluses)

- Government must borrow money when it runs a budget deficits

- Government borrows from: individuals, corporations, financial institutions, foreign entities or foreign governments

Fiscal Policy Two Options

- Discretionary Fiscal Policy (action)

- Expansionary fiscal policy - think deficits (recession)

- Contractionary fiscal policy - think surplus (inflationary period)

- Non-Discretionary Fiscal Policy (no action)

Discretionary v. Automatic Fiscal Policies

Contractionary vs. Expansionary Fiscal Policy

- strategy for controlling inflation

- strategy for increasing GDP combating a recession & reducing unemployment

Expansionary Fiscal Policy

- Increases government spending

- Decrease taxes

Contractionary Fiscal Policy

- Decrease government spending

- Increase taxes

Automatic or Built-In Stabilizers

- Anything that increases the government's budget deficits during a recession and increases its budget surplus during inflation without requiring explicit action by policy makers.

Nondiscretionary Fiscal Policy (Automatic Stabilizers)

1) Transfer Payments

- Welfare checks

- Food Stamps

- Unemployment checks

- Corporate dividends

- Social Security

- Veteran's benefits

Progressive Tax System: Average tax rate (tax revenue/GDP) rises with GDP

Proportional Tax System: Average tax rate remains constant as GDP changes

Regressive Tax System: Average tax rate falls with GDP

The Three Schools of Economics

Classical:

- Adam Smith, John B Say, David Ricardo, and Alfred Marshall

- competition is good

- invisible hand: the market basically runs itself

- laissere faire: no government intervention

- say's law: supply creates its own demand

- economy is always close to or at full employment

- in the long run, economy will balance out at full employment

- trickle down effect: help rich first, then help everyone else

- savings increase with the interest rate

- prices and wages are flexible and downward.

- AS determines output.

- AS=AD at full equilibrium.

Keynesian:

- John Maynard Keynes, Congress

- competition is flawed

- AD is the key, not AS

- Demand creates its own supply, AD creates its own output

- Savers does not equal investment

- Savings are inverse to interest rates

- Leaks causes constant recessions

- Savings also causes recession

- Ratchet effects and sticky wages block Say's law

- Since there is no mechanism that is capable of garunteeing full employment, in the long run we are dead

- The economy is not always close to or at full employment

- Uses Fiscal Policy, Will add stabilizers , Will use expansionary and contractionary policies.

Monetary:

- Allen Greenspan, Ben Bernanke

- Congress can't time the policy option

- Voters won't allow contractionary options

- Easy money/Tight money

- We can change the required reserves of needed.

- We can buy and sell bonds through open market operation

- We can use the interest rate to change the discount rate and the federal fund rate